Last Sunday, November 1, 2015, the first talk of The Feast Bay Area’s brand new talk series entitled, “Debt-Proof Your Life,” began. I had the privilege to attend the talk and I would like to share what I learned from Bo Sanchez on how one can become debt-free.

Are you drowning in debt? Do not worry. There are three things that you can do to get out of debt and live happily rich ever after.

How To Become Debt-Free by Bo Sanchez

1. Commit to becoming debt-free now. Yes, you read that right. You need to commit NOW. Not tomorrow or next year or when you start earning a bigger salary. If you do not commit to becoming debt-free now then you will not commit ever.

Bo Sanchez mentioned that paying debt is not just a financial issue. It is also a spiritual issue. He then quoted from Proverbs 37:1, “The wicked borrows but does not pay back, but the righteous is generous and gives.” God is pleased with people who pay their debts and who make good on their promises. It would be worthwhile to remember this Bible passage if you need a reason why you should commit to becoming debt-free now.

2. List down your debts. Writing down all your debts will help you identify the smallest debt that you have. After identifying your smallest debt, you can then start paying for it right away. This would create momentum and also build your confidence. Imagine the feeling of accomplishment that you will have when you finish paying for your smallest debt. 🙂

Listing down your debts will also help you identify the high interest rate debts that you owe which you need to pay first. Paying for these first will save you from drowning deeper.

Bo Sanchez also urged the audience to talk to their creditors. They need to talk to their creditors to ask for better terms. Nine out of ten creditors say “yes” to better terms because they would rather have those who owe them money pay slowly than letting them go bankrupt because of paying high interest rates and end up not getting paid at all. Bo Sanchez shared that most creditors would be glad to be paid the principal amount owed them than not getting back anything at all.

3. Add no new debt. To be able to do this, you need to discipline your expenses. You also need to remember the cardinal financial rule: spend less from what you earn and invest the difference.

Bo Sanchez shared some tips on how to discipline your expenses.

When grocery shopping, have a list and stick to your list. Don’t bring your kids or your husband to the grocery with you because they tend to add things to the cart which are not in your list and which you might have a hard time declining to buy that you end up spending more.

For your clothes, it is better that you do not buy branded and expensive clothes.

There are also other tips that he shared that can help one become debt-free. These include: stop using a credit card if you do not have the discipline and if you are using a credit card, pay all the charges 100% at the end of the month. The latter would save you from incurring charges and you get to earn rewards as a bonus. 🙂 Do not be too aggressive when borrowing for business because this might just become an emotional burden. Borrow for business if you must but be prudent.

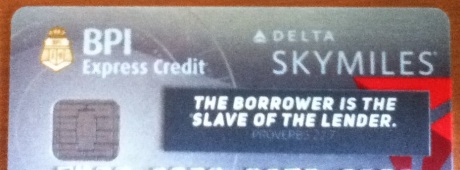

Stickers where Proverbs 22:7 was written were distributed to the attendees which they can place on their credit cards to make them think twice before they swipe.

At the end of the talk, the ushers distributed stickers where the words from Proverbs 22:7, “The borrower is the slave of the lender.”, were written. They asked each of the attendees to place the sticker on their credit cards so that once they see these words, they will think twice before they swipe. 😉

This talk series will CHANGE YOUR LIFE. Do not miss it! Catch the rest of the talks every Sunday at The Feast Bay Area until November 15, 2015.

Blessings!

P.S. Do you want to retire rich? Invest in the stock market! Join the Truly Rich Club to learn how. Join here.

Say NO to get-rich-quick schemes, YES to the Truly Rich Club.

[…] Employees Can Earn Millions In The Stock Market "Take Charge Of Your Financial Future. I believe investing small amounts each month in the stock market will give you financial freedom in the later years of your life." – Bo Sanchez « How To Become Debt-Free […]