“Great things start from small beginnings.”

How was your 2016? Did you achieve the goals or resolutions you’ve set at the beginning of last year? If your answer is no and you’ve decide not to set goals or resolutions anymore because of your frustration maybe this post can help make a difference.

Do away with frustration by setting small, achievable goals. Achieving small goals in shorter spans of time builds confidence. Also, listing just one or two goals you want to attain in several areas of your life helps eliminate the feeling of overwhelm.

Here’s a list of some small money goals you can make this 2017. Pick one or two only and give yourself a pat in the back at the end of the year because you made it. 🙂

SAVE. If you have not saved a single centavo all your life because you are intimidated and think that you don’t have enough to save, you can start putting aside a small amount (maybe 5 pesos a week) to start the ball rolling. Did you know that you will have a total of P 6,890.00 saved at the end of the year when you set aside increments of 5 pesos a week for the 52 weeks that make a year? Visit this for the table on how to do this.

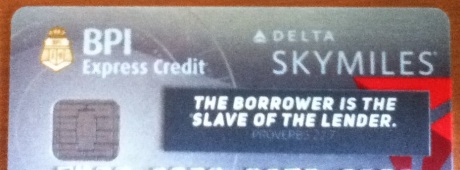

PAY OFF DEBTS. Liberate yourself from the chains of debt. Refer to this post for the steps on how to become debt-free.

BUILD AN EMERGENCY FUND. Investopedia defines emergency fund as an account that is used to set aside funds to be used in an emergency such as the loss of a job, an illness or a major expense. An emergency fund buys one security. Start building yours now by setting aside a percentage of what you think you can afford. Whether it’s a fund good for 3 or 6 months is a person to person basis.

LEARN ABOUT INVESTING. “It’s not how much money you save. It’s what you do with what you save.” Do not settle for peanut interest rates earned from banks’ savings accounts. You deserve more. Learn how to grow your money by investing in vehicles which give higher interest rates such as corporate bonds, retail treasury bonds, mutual funds and the stock market. Learning does not have to be expensive. Download a FREE copy of the e-book, “My Maid Invests In The Stock Market… And Why You Should, Too!”, here to understand how the stock market works, how to earn from it and a system of investing that has made two helpers and a driver now richer than many managers.

There you have it. Four small goals that you can choose from and improve your finances by the end of the year. 🙂 Do you have other money goals that you want to include in the list? Share them in the comments box and bless others with your ideas.

Happy 2017!